Wealth

Management

Consulting

DCAM provide an advisory Wealth Management Consulting (WMC) service that conducts an overall review of the family group wealth, with a view of increasing the efficiency of the distribution of assets, including and not limited to restructuring advice once the overall risk profile or guidelines are agreed.

Within the WMC service a particular emphasis is placed on generational planning whereby DCAM has well established working relationships with a number of Fiduciary Trust Companies.

The WMC as well includes but not limited to the following services:

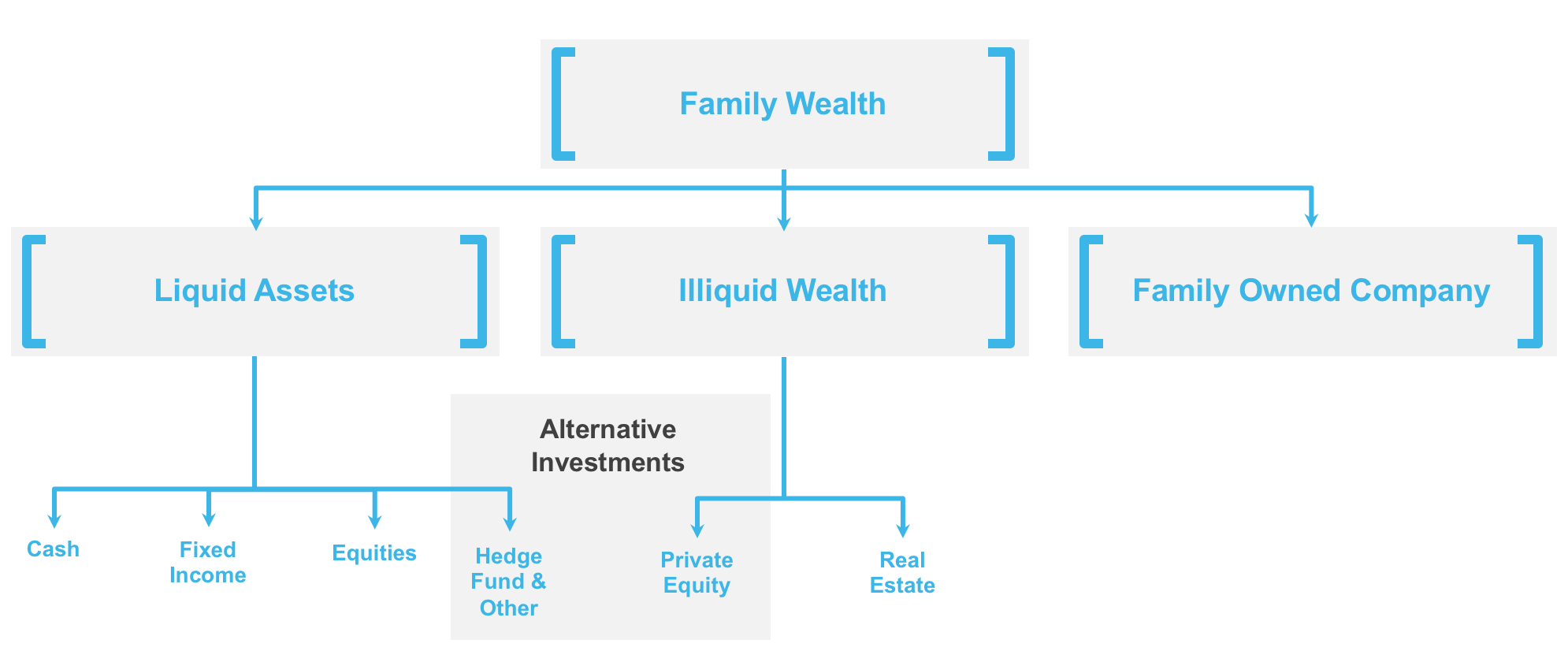

- Advising on the overall distribution of the Client Assets between the Client Business Assets, Client Illiquid Investments and Client Liquid Investments, while further taking into consideration the geographical exposure and any investments that are strategic in nature.

- Reviewing arrangements in place with third party service providers relating to the Client Illiquid Investments and Client Liquid Investments and advice on re-structuring such arrangements, and the procedures in place towards the selection and monitoring of service providers and related matters;

- Advising on the establishment and/or operation of a private family office responsible for investment of Client Assets, including advice as to staffing, recruitment, responsibilities and other operational matters;

- Advising on the set-up, composition and operation of an Investment Committee responsible for investment decision making in relation to the Client Illiquid Investments and Client Liquid Investments;